In my role as Experience Design Director, I oversaw the reimagining of Santander’s commercial banking experience - facilitating stakeholder workshops, leading the research phase, and providing the creative direction required to turn complex requirements into a sophisticated, production-ready digital product.

Research & competitive analysis

I led the initial discovery phase by undertaking competitive market analysis and direct user interviews.

By auditing both traditional and challenger banks and speaking directly with business customers, I identified a critical demand for mobile account opening.

These insights to architect a multi-channel strategy that clarified the specific roles of the app, website, and branch, ensuring a frictionless experience regardless of touchpoint.

Design workshops

Exploring conceptual journeys & requirements

I facilitated a two-day strategic workshop to map the future customer journey, anchoring the session in behavioural science principles to address the psychological barriers business owners face during onboarding.

I led the exploration of two paths: a refined traditional flow and an AI-driven journey. I focused on how we could use choice architecture and ‘nudges’ to build trust while automating data entry.

By demonstrating how we might drastically lower the cognitive load required to complete a complex task, I moved stakeholders toward a ‘North Star’ journey – a ideal-state blueprint for an intuitive, low-friction experience.

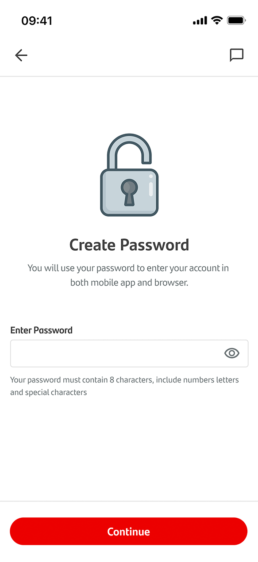

Design concepts

UX, UI, and Behavioural design

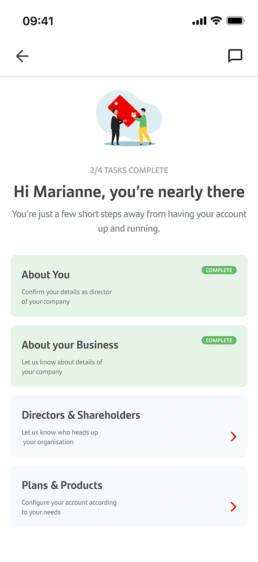

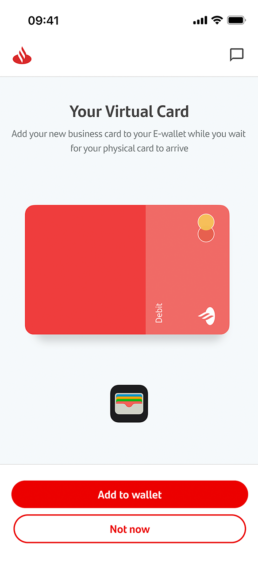

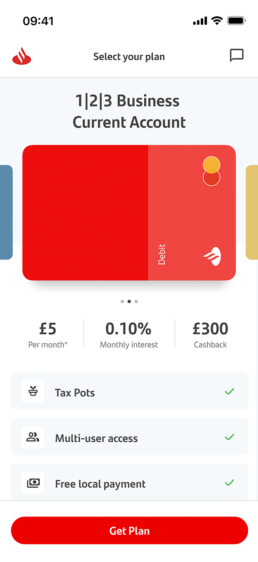

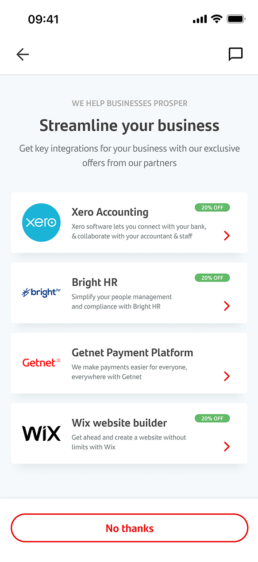

I directed the creative exploration, translating the strategic user flow into high-fidelity designs and a high-fidelity, interactive prototype.

By embedding principles from behavioural economics, I oversaw the implementation of intuitive ‘nudges’ designed to guide user behaviour and proactively minimise drop-off points.

This prototype served as a critical alignment tool for senior stakeholders and provided Santander’s in-house team with a robust framework to validate the experience through real-user testing, directly informing subsequent design iterations.

Design production

Refining concepts into development-ready screens & interactions

I directed the transition from prototype to final design, ensuring seamless integration with Santander’s established design systems and governance frameworks.

By working alongside their in-house design team, the core journey was finessed to account for the full spectrum of user states and edge cases.

I also led the cross-functional alignment with Risk, Compliance, and Technology teams, ensuring that the high-fidelity execution was as legally and technically sound as it was user-centric.

Results

This comprehensive transformation from a slow, branch-only process into a streamlined digital experience empowered customers with a faster, more intuitive way to set up and manage manage their accounts, boosting both confidence and satisfaction.

4.7

app store rating

25%

increase in CSAT scores

85%

same-day application processing